Business Advisory Services, Tax and Assurance ('Middle Tier' Firms) Report

The Business Advisory Services, Tax and Assurance (‘Middle Tier’ Firms) Report offers detailed remuneration and benefits information for key business advisory, tax and assurance roles. The report covers the same roles as the ‘Big 4’ Tax and Assurance using competency levels reflecting the ‘Middle Tier’ structure

PARTICIPANTS & ROLES SURVEYED

PARTICIPANTS

1,423

EMPLOYEES

30

JOBS

ROLES SURVEYED

- Tax

- Assurance

- Business Advisory Services

- Tax & Assurance Combined

DISTRIBUTION, ANALYSIS & FEATURES

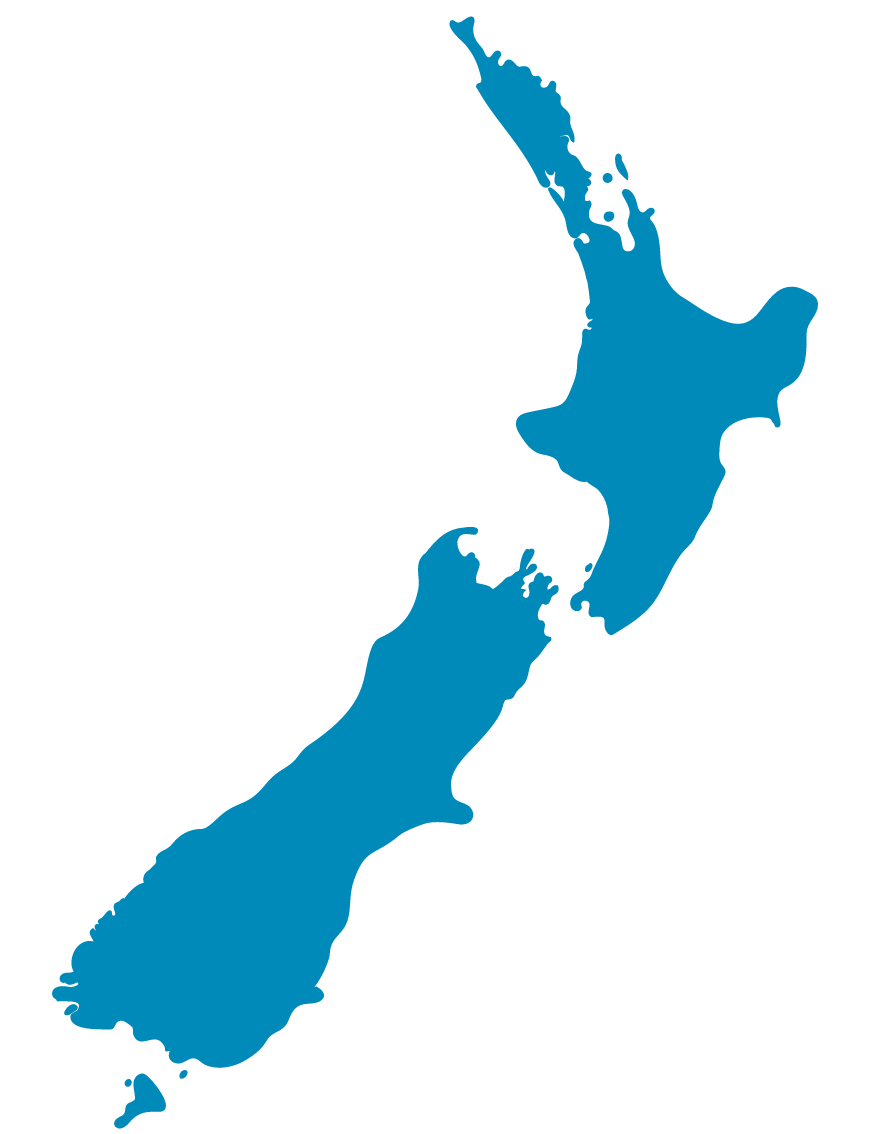

DISTRIBUTION BY REGION

AUCKLAND

37%

OTHER NORTH ISLAND

18%

14%

WELLINGTON

OTHER SOUTH ISLAND

19%

12%

CHRISTCHURCH

- Auckland: 37%

- Wellington: 14%

- Other North Island:18%

- Christchurch: 12%

- Other South Island: 19%

ANALYSIS & FEATURES

- Market Movements

- Salary Increases & Forecast Trends

- Same Incumbent Movements

- Regional Differences

- Salary Review Periods

- Allocation of Pay Increases

- Overtime / Outside Normal Hours

- Turnover / Recruitment

- Gender

- Annual Leave / Training

- KiwiSaver

PARTICIPATION

For information about survey participation, please get in touch with our Survey Team

TIMING

Data for this survey is collected from October to November, with the report published annually in January

This report is only available to purchase by certain organisations